Understanding UK Logbook Loans

If you are facing a financial emergency, you may be looking for a quick and easy way to borrow money to help you out of your situation. One type of loan that is both quick and easy to obtain is a logbook loan, however, there are substantial risks involved with this type of loan.

If you are facing a financial emergency, you may be looking for a quick and easy way to borrow money to help you out of your situation. One type of loan that is both quick and easy to obtain is a logbook loan, however, there are substantial risks involved with this type of loan.

A logbook loan is a secured loan that you can obtain against the equity in your car. These loans allow you to borrow between £500 and £50,000, depending on the overall value of your car.

Logbook loans almost always come with a high interest rates plus additional fees and charges. In fact, many of these loans offer an APR (Annual Percentage Rate) as high as 400 percent. It is important that you understand exactly how these loan work, in order to determine if it might be the right type of loan for you. Below is some additional information about logbook loans.

How Do Logbook Loans Work

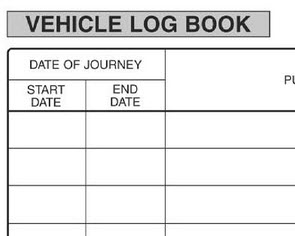

The first step to obtaining a logbook loan is to complete a short application that usually can be completed online. You must have regular employment and own a vehicle right out. With this type of loan, you will be required to use your vehicle as collateral against the loan. While the amount of the loan will be dependent on the value of your vehicle, you will likely only be able to obtain a loan for about 50 – 75 percent of the vehicle’s overall value. Before this loan can be finalized, you must provide the lender with your logbook, or vehicle’s registration certificate to prove you want the car.

With a logbook loan, the lender will actually own your car during the duration of your loan. You will have the ability to continue driving your vehicle, but you will not technically own the car until you debt is paid in full. You will then be required to repay the loan in accordance to a predetermined repayment plan. If you are unable to repay the loan according to the predetermined terms, the lender has the right to repossess your vehicle to cover the costs of the money you owe them. This is considered a Bill of Sale transaction, and therefore does not require a court hearing in order for the lender to legally take possession of your car.

Pros:

There are several advantages to obtaining this type of loan, such as:

– Offers a quick and easy way to obtain money in the event of an emergency.

– Does not usually require a credit check, making it a good option of those with poor credit. It is a secured loan though.

– Depending on the value of your car, you may be able to borrow more money with this type of loan than some other alternatives.

Cons:

There are also several disadvantages of obtaining this type of loan that should be considered very carefully.

– You must own a vehicle in order to qualify for a logbook loan.

– You could lose your vehicle if you cannot repay the money on time. Therefore, this loan should only be obtained by those who are 100 percent sure, they will be able to repay the loan according to the conditions.

– Payment may be deducted directly out of your bank account, taking away any control you may have to withhold payments.

– Typically, logbook loans have very high interest rate, which means you will be paying back significantly more money than you borrowed in the first place. You should always read the terms and conditions with any logbook loan before making your final decision.

Logbook loans do serve a purpose and may be a good option in certain circumstances. There are however other alternatives which may prove to be a better options such as certain benefit loans or even non-loan options. Be sure you understand the terms and costs attached with any loan you may be considering.